Get the free california form 540x 2010 - ftb ca

Show details

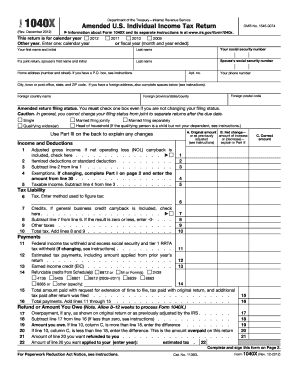

TAXABLE YEAR CALIFORNIA FORM Amended Individual Income Tax Return 540X BE SURE TO COMPLETE AND SIGN SIDE 2 Fiscal year less only: Enter month of year-end year. Your RST name Initial Last name Your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your california form 540x 2010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california form 540x 2010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california form 540x 2010 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california form 540x 2010. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out california form 540x 2010

How to fill out California Form 540X 2010:

01

Gather all necessary information and documentation such as your original California Form 540 for the tax year 2010, any supporting documents or schedules, and any amended tax forms.

02

Fill out the top section of Form 540X, including your name, address, Social Security number, and the tax year as "2010".

03

Indicate whether you are filing a joint or separate return by checking the appropriate box.

04

Complete Part I - Reason for Amending, by selecting the reason for the amendment from the available options.

05

If you are changing numbers from the original Form 540, fill out Part II - Changes to Your Taxable Income and Deductions. Include any adjustments, deductions, or credits you are changing.

06

In Part III - Changes to California Tax, fill out any changes to the California tax you owe, including the changes to your tax credits or payments.

07

Calculate the difference between your original tax liability and your amended tax liability in Part IV - Summary of Changes.

08

Provide a detailed explanation of the changes made in Part V - Explanation of Changes.

09

Attach any necessary additional forms, schedules, or supporting documentation to your amended return.

10

Double-check all the information provided, sign and date the form, and keep a copy of the amended return for your records.

Who needs California Form 540X 2010?

01

Individuals who have already filed their original California Form 540 for the tax year 2010.

02

Taxpayers who need to correct errors or make changes to their original tax return filed for the tax year 2010.

03

Individuals who want to claim additional deductions, credits, or adjustments not included on their original tax return for the tax year 2010.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

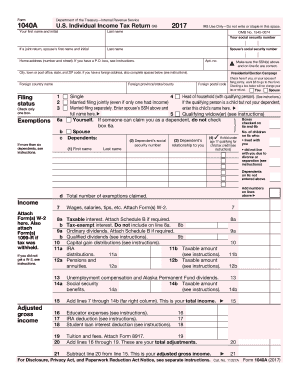

What is california form 540x?

Form 540X is a tax return form used by residents of California to correct errors or make changes to their original Form 540 or Form 540NR. It is known as the Amended Individual Income Tax Return. This form is used when taxpayers need to make changes to their filing status, income, deductions, credits, or adjust payments made in the original tax return. It is important to note that this form can only be used to amend California state tax returns and not federal tax returns.

Who is required to file california form 540x?

California resident individuals who need to correct their California income tax return for any reason are required to file Form 540X. This includes individuals who made errors or omissions on their original tax return, or individuals who have been notified by the California Franchise Tax Board of any discrepancies or adjustments.

How to fill out california form 540x?

To fill out California Form 540X, which is used to amend your individual income tax return, follow these steps:

1. Download a copy of Form 540X from the California Franchise Tax Board (FTB) website.

2. Begin by entering your personal information, such as your name, Social Security Number, and filing status, at the top of the form.

3. In Part 1, provide details about the original tax return you are amending. This includes the tax year you are amending, the type of return you originally filed (e.g., Form 540, Form 540NR, etc.), and the filing status on your original return.

4. In Part 2, explain the specific changes you are making to your original return. Use the provided lines to describe each change, including any necessary supporting documentation or attachments. Include explanations for additions, subtractions, and adjustments to income, expenses, or tax credits.

5. Calculate the changes made to your adjusted gross income (AGI) in Part 3. Follow the instructions provided to compute the revised AGI, taking into account the changes reported in Part 2.

6. In Part 4, determine whether the changes made in Part 2 result in additional tax owed or a refund due. If you owe additional tax, enter the payment amount and include a check or money order with your amended return. If you are entitled to a refund, enter the amount and indicate how you wish to receive it (e.g., direct deposit, check).

7. Complete Part 5 if you are amending your tax return due to changes made by the IRS or another state taxing authority. Provide information about the changes and furnish copies of the relevant documentation or correspondence.

8. In Part 6, verify that you have included all attachments and supporting documentation, such as schedules, forms, or worksheets related to your amended return.

9. Review your completed Form 540X for accuracy and ensure that all required information has been provided.

10. Make a copy of the completed form and any accompanying documentation for your records.

11. Mail the original Form 540X along with any payment (if applicable) and necessary supporting documents to the address specified on the form. Retain proof of mailing for your reference.

Remember to consult the instructions provided with Form 540X or seek professional assistance if you have any questions or need further clarification while completing the form.

What is the purpose of california form 540x?

The purpose of California Form 540X, also known as the Amended Individual Income Tax Return, is to correct any errors or make changes to a previously filed California Form 540, the Individual Income Tax Return.

Some common reasons for filing Form 540X include correcting errors in reporting income or deductions, claiming additional deductions or tax credits that were initially missed, updating information related to dependents, and adjusting tax liability based on changes in marital status or residency.

Form 540X allows taxpayers to amend their original tax return and provide the revised information to the California Franchise Tax Board.

What information must be reported on california form 540x?

The California Form 540X is used to amend a previously filed California resident tax return (Form 540). It is necessary to provide the following information on the Form 540X:

1. Personal Information: Provide your name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and filing status.

2. Amended Return Information: Include the tax year you are amending and the original or adjusted return filed (Form 540, 540A, or 540EZ). Indicate whether you are increasing or decreasing the amounts reported on your original return.

3. Explanation of Changes: Provide a detailed explanation of the changes being made and the reasons for the amendments. Include any relevant forms, schedules, or worksheets that support the changes.

4. Income Adjustments: Report any changes to your income, such as additional or reduced wages, self-employment income, rental income, dividends, etc. Include the corresponding form, schedule, or worksheet (e.g., Schedule CA for California adjustments).

5. Deductions and Credits: If there are changes in your deductions or credits, report them on the appropriate section. Include corresponding forms, schedules, or worksheets (e.g., Schedule CA for California adjustments, Schedule D for capital gains/losses).

6. Payments and Refunds: List any additional payments made or refunds received after filing the original return. Provide the payment or refund dates, amounts, and payment type (check, electronic payment, etc.).

7. Calculation of Tax: Calculate the new tax liability based on the amended changes. Indicate any overpayment or balance due.

8. Signature and Date: Sign and date the Form 540X to certify the information provided is accurate and complete.

Remember to include any necessary supporting documents and attachments along with the Form 540X when filing.

When is the deadline to file california form 540x in 2023?

The filing deadline for California Form 540X for the tax year 2023 is April 15, 2024. However, if April 15th falls on a weekend or holiday, the deadline is usually extended to the next business day.

What is the penalty for the late filing of california form 540x?

The penalty for late filing of California Form 540X depends on the circumstances. If you owe additional taxes, the penalty is generally 5% of the unpaid tax for each month (or part thereof) the return is late, up to a maximum of 25% of the unpaid tax. However, if you file your return more than 60 days after the due date, the minimum penalty is $135 or 100% of the tax due, whichever is less.

If the late filing results in a refund, there is generally no penalty. However, you must file the amended return within four years from the original filing due date or within one year from the date you paid the tax, whichever is later, to claim a refund.

How can I get california form 540x 2010?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the california form 540x 2010 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute california form 540x 2010 online?

Filling out and eSigning california form 540x 2010 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit california form 540x 2010 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing california form 540x 2010.

Fill out your california form 540x 2010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.